- Trends

- Posts

- June 2023

June 2023

It is probably not wise to send this month’s email the Friday before a holiday weekend, but June was a crazy month and I did not want to miss the opportunity to share a few important observations.

Healthcare providers continue to struggle, a trough that began to form in early 2022 and looks like it will have a grip on the industry for two years or more.

Scarce cash, low margins, and high labor costs are the primary impacts being seen across the board by hospitals, health systems, clinics, and physician practices. And as patient volumes return, they are not always returning in the places or for the services that health systems intended or expected, creating more unpredictability.

Margins and Liquidity

While still very market-specific, we are seeing margins gradually recover some of the ground that was lost in 2022. The shift is subtle and not occurring quickly, but many health systems observe that they may have bottomed-out in Q4 2022 or Q1 2023, and monthly reporting suggests that Q2 will finish with a slight improvement. The organizations in the best position to recover are those who underwent cost structure improvements in 2022 or early 2023, or whose payer mix includes higher-margin revenue, making their margins more responsive to volume recovery. The margin recovery is slight – perhaps 50 to 150 basis points year-over-year, and in many cases still negative.

New financing activity is steady, but still down from last year. Healthcare organizations are not entirely frozen when it comes to financing, but volumes for municipal and healthcare debt issuances are still down close to 20% year-over-year. Why is it important to watch financing activity? It is a sign that health providers are (or are not) investing in remodel, upgrading, or new building projects, which often accommodate the demand for specific services from patients, and keep our safety net hospitals up-to-date.

Cash is still the focus. For those organizations who have not experienced a bottoming-out of margins, focusing on a cash culture is critical right now. Some organizations are tapping in to financial reserves, while others are trying to improve their cash profile through quick-hit margin improvement initiatives and revenue cycle improvements. The past 18 months underscored the need to have strong financial reporting systems, which include precise cash flow forecasting as a core part. Even nonprofit health systems need to find a way to breakeven, or the difference has to come from somewhere.

Provider Initiative Spotlight - Cultural Health

My clients are renewing the focus on their organization’s execution competency and culture. There is a lot of fatigue in healthcare right now, as the pandemic stress immediately gave way to margin stress. We like to say that for many organizations, doing a big improvement initiative right now feels like doing a sprint at the end of a marathon. Increasing your leaders’ change management skills and ability to drive change – even if you are using the do-it-yourself model for performance improvement – can help improve the speed and sustainability of whatever you are trying to do.

Even well-run organizations took a step back on leadership practices over the past 36 months. As the pandemic hit, a perfect storm of factors affected organizations’ leadership culture. Some examples: Given the nursing shortage, leaders found it difficult to performance-manage nurses. And given the all-hands-on-deck nature of the pandemic, many leaders did more front-line work and lost some of the leadership habits they had built.

Huron is helping organizations bring back a culture of execution – using our methodology to add structure to an area that is often left to instinct or institutional memory. This is borne out of the Studer Group methodology that has been part of Huron since 2015.

Education Event

What's Right in Health Care® is Huron’s premier annual conference where hundreds of healthcare leaders convene to learn and rejuvenate through peer-to-peer idea sharing, innovative concepts, and social activities. Join industry-leading presenters focused on providing healthcare professionals with practical takeaways to drive lasting change in their organizations. Discounted registration fees may be available – let me know if you are interested. The conference is August 14 - 16 in Chicago.

Recommended Reads / Listens

I found this recent podcast interview with health industry investor and founder Justin Mares interesting. In it, he discusses how things like the typical American diet are contributing to our health care costs. Example: The typical public school lunch menu is, in itself, a diabetes risk factor.

CMS released its most updated (based on 2021 figures) Fact Sheet on national health expenditures, which provides lots of links to drill-down data. It is always interested to get a refresher on where the health care dollars are going from a macro standpoint.

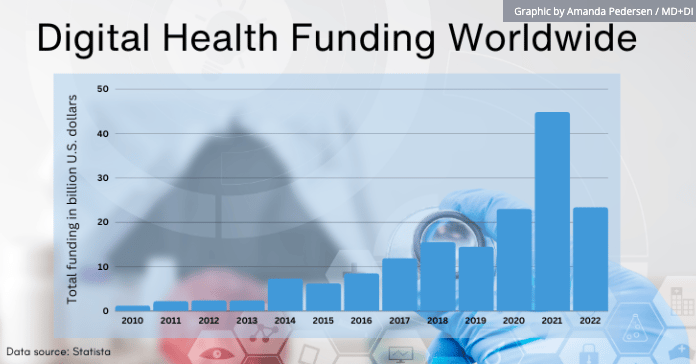

Chart of the Month

The outside funding (from VC and PE) into Digital Health felt like it dried up in 2022, but in reality it was just that 2021 was such an anomaly to the upside. No doubt, the 1st half of 2022 and the 2nd half were probably very different, but in total 2022 simply fell back to 2020 levels.

I hope you enjoyed the letter. You’ll hear from me again in July!