- Trends

- Posts

- March / April 2023; Provider Cash Crunch

March / April 2023; Provider Cash Crunch

A look at provider margins, travel nursing costs, and more

The first quarter is wrapped, and if there is one truth in the U.S. healthcare provider industry, it is that cash is scarce.

Even in an industry where about 60% of hospitals are nonprofit and another segment is government run, you still need a sustainable cash flow statement in order to fund investments and pay market salaries to your talent.

When I someday look back on my career, 2022 and 2023 will prove to have been one of the “perfect storms” in the provider market.

Margins and Liquidity

2022 annual reports confirm that the year was a big step back for provider finances. Probably not a surprise to anyone, but nobody was immune from 2022’s financial pressures. Operating margins dropped to a median of .9% according to an analysis by Fitch. The key driver was the spike in cost of variable labor, against a relatively fixed revenue base. (More on agency expenses later.)

Looking ahead, the expectation is that 2023 will still be in the margin trough, but not with the same year-over-year decline that we saw from 2021 to 2022. Most clients are focused on late 2023 and 2024 as the recovery period as renegotiated rates, tamed labor costs, and the impact of performance improvement initiatives should converge and make for a better year.

Cash is king right now. Stats from a variety of sources are surprisingly consistent on the erosion of cash reserves. Across the board, days-cash-on-hand dropped by about 40 days for providers in 2022, consistent with the pace that we were seeing during the year of about 10 days deterioration per quarter.

Even if your goal as a nonprofit is simply to breakeven, being starved for cash reduces your optionality month-to-month, and often forces you to make shorter-term choices when a longer-term view would be preferred.

Provider Expense Spotlight - Agency Staffing

Across the board, agency clinician staffing is the top area of focus in many of our expense management projects. It is hard to overstate the impact of agency expenses right now, as they are singlehandedly tipping many providers from positive to negative margins. Organizations who are doing well might be running at an agency level that is 50-75% higher than pre-pandemic. Those who are struggling have seen their agency costs increase by 7x or more since that time.

We are encouraged by agency labor approach we have been deploying with clients – which often center on improving retention for your own, non-agency staff by making the organization a better place to work.

Fortunately, we are also seeing a cresting of agency costs in many (not all) markets and a gradual decline in some. The leveling-off is driven both by slight agency rate declines, and agency usage reductions. The exception is in some specialty areas like OR and Pharmacy, where both agency demand and rates are still very high.

Education Event

What's Right in Health Care® is Huron’s premier annual conference where hundreds of healthcare leaders convene to learn and rejuvenate through peer-to-peer idea sharing, innovative concepts, and social activities. Join industry-leading presenters focused on providing healthcare professionals with practical takeaways to drive lasting change in their organizations. Discounted registration fees may be available – let me know if you are interested. The conference is August 14 - 16 in Chicago.

Recommended Reads / Listens

The American Hospital Association summarized what the Public Health Emergency’s conclusion means as well as anything I have seen. It is worth a read. (reminder, the PHE concludes on May 11.)

Generative AI has dominated the news since Chat GPT was introduced late last year. While the technology is amazing, one big, unanswered question is “Who owns the content?” HBR did a piece on the subject. It is far from a settled issue.

David Sacks’ (Founding COO of Paypal, current VC) has a great way of thinking about your operating cadence. Not a new podcast, but always worth a refresh for anyone with operations responsibilities.

Chart of the Month

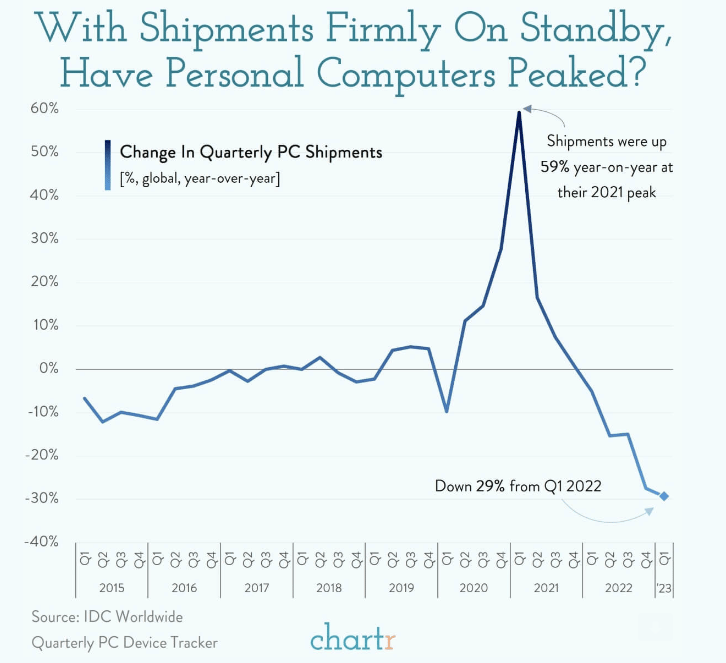

Shipments of PCs spiked during the pandemic, presumably from the need for improved virtual work capabilities by workers and students alike. Just like with things like Peloton and even certain aspects of telehealth, the trend has reversed in a big way.

I hope you enjoyed the letter. You’ll hear from me again in May!