- Trends

- Posts

- February 2023: Emergency's End, 340B, and Healthcare Capital Markets

February 2023: Emergency's End, 340B, and Healthcare Capital Markets

February 2023: The End of the Emergency

February in the provider healthcare world was dominated by the early-month news of the Biden Administration ending the Public Health Emergency, a status that had been in effect for nearly three years. I will take a deeper look at that, plus other healthcare delivery and provider buzz.

Public Health Emergency to Wind Down

While it was definitely a buzz back when I wrote the January letter, early February made official the end to the COVID Public Health Emergency (PHE). The news was expected. In fact, there was some speculation in late 2022 that the PHE could conclude then.

Ending the PHE has many ripple effects, but the ones that affect healthcare providers are what I’m most focused on. Some highlights (or lowlights, depending on how you might be impacted) include:

Less Medicaid coverage. During the PHE, states could not remove enrollees from Medicaid programs. Now that the restriction is lifted, expect a pent-up flood of people rolling-off of Medicaid, many to being uninsured.

Some telehealth restrictions are back. The PHE relaxed many telehealth regulations while it was in effect. While some were made semi-permanent by separate legislation (a great move in my opinion), some of the relaxed rules will snap back to the way there were before when the PHE concludes.

Lower reimbursement for COVID-related treatment. A 20% additional payment on COVID patients was intended to offset the unplanned cost of treating patients in a COVID era, and the strain on resources during that time. That ends.

The net of it, if you are a hospital, health system, or medical group, is that you were just handed more headwind during an already-tough financial year. It is hard to argue that lifting the PHE is premature, though.

Interest Rates Have Not Yet Settled

In December, I had a number of conversations with healthcare bankers, and concluded that interest rates may finally settle (albeit at a much higher level than a year ago) as 2023 began. Seeing rates stabilize would help melt the thaw of capital markets, as no CFO wants to begin a 2-to-3-month financing effort into a rising rate environment.

The tone changed in February, when the Fed acknowledged that inflation is not yet under control, meaning further rate hikes are very much on the table. All indications now are that the Fed funds rate could ratchet up another full point in the first part of 2023.

Climbing rates directly impacts most healthcare providers, as they wait out the rate ride. Higher rates translate to a few things:

Delayed capital projects. Building projects or major technology investments (like ERP installs) that did not have financing already lined-up are seeing start dates pushed out. I have personally had multiple clients push major capital-intensive projects in the past 45 days.

Using cash-on-hand. Providers are using cash-on-hand more readily, creating a lower stockpile of money in the bank. The popular Days-Cash-On-Hand metric has been decreasing at a rate of about 10 days per quarter, on average.

Potential crunch time ahead. Not everyone was lucky enough to lock in low rates back in 2021 or early 2022. For providers who have loans coming due (terms expiring, balloon payments), they need to refinance. We are helping many figure out how to artfully do this in this environment.

340B Program Usage Scrutiny

340B Drug Program usage has been a big buzz in 2023. I first noticed much discussion on the topic at the JPM Conference, and it has only gotten louder.

For those who are not immersed in it, the 340B program provides drug discounts for certain healthcare providers, such as those serving populations with disproportionate need or childrens’ providers.

Since 2020, many pharma manufacturers have taken steps to limit access to the 340B program, reducing the level of drug discounting that providers have access to. In February, additional limits were introduced by some manufacturers.

Providers will tell you that the 340B program discounts - typically 25% to 50% - allow them to stretch scarce resources as far as possible, in an environment where margins are already thin and breakeven is never guaranteed. They insist that restricting 340B access is unlawful.

Pharma companies will tell you that they feel the program is not always being used as intended, and drug savings are not always being passed along to patients. They would like to see the program used more sparingly.

A showdown is brewing on the subject, both legislatively and legally, and the Commonwealth Fund did an explainer on the subject that was well-done, if you want to learn more.

Good Reads

Quartz did a piece on the financial challenges facing nursing homes. A two-punch stat that struck me: 60% of nursing home patients are on Medicaid, and Medicaid only covers 86% of the cost of care. Not a recipe for long-term success. Further, in many cases, the ownership of the nursing home real estate and operating organization are often separate, so even if you are on strong real estate, it might not be able to help your operation.

While a bit dry, an interesting study on process goals versus outcome goals, at least in the world of sports. I think it applies to other areas of personal performance, too. Punch line: Process goals do more to elevate performance than outcome goals.

Chart of the Month

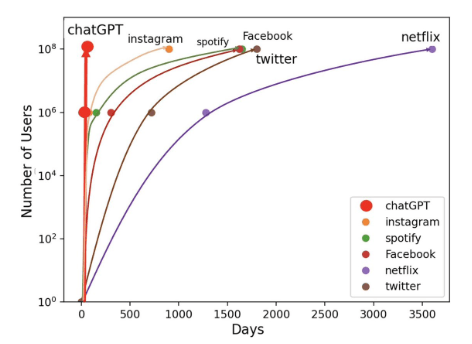

ChatGPT has gained user adoption at an astonishing rate. It reached 100 million users faster than Instagram, Spotify, Facebook, and other viral platforms. Amazing when you think it doesn’t really have network effects like the others have.

Looking Ahead

I will be watching several things in March, including if any other elements of the Public Heath Emergency which are set to expire will be made permanent. I am also curious to see year-end financials from those health systems on 12/31 fiscal years. I expect 2022 year-end margins for many to be the lowest they have ever disclosed.

Look for more on those topics in next month's letter.

Feel free to contact me if you would like to discuss any of this information in more detail. [email protected]