- Trends

- Posts

- What is on CEO and CFO minds for 2024

What is on CEO and CFO minds for 2024

A few recurring themes at the recent Becker's conference and other discussions

It is always interesting to hear what is on the minds of health system and provider CEOs and CFOs, whether I am meeting with them 1-on-1 or attending panel discussions like I did a couple weeks ago at the Becker’s CEO/CFO event.

What has been notable the past couple years has been how consistent the CEO perspectives have been, regardless of provider size or geography. That is a departure from a few years ago, when every conversation with a C-suite executive was noting varying, unique challenges or future plans.

I posted a high-level summary of these themes on LinkedIn, and with good reception. In this letter, I will take a minute to expand on four of the points.

Intentional Growth

Growth is a focus across the board, but what has changed is the type of growth. Growth needs to be intentional and focused on serving your specific population.

“No more growing just to grow.”

I’ve been hearing this with my clients, increasingly since the pandemic settled-down. The focus of growth is much more targeted than it was in the past, when the name of the game was about scale. Now, it is about:

Finding service areas you excel in, and making those a higher proportion of your service mix

Looking at micro-geography targeting for outpatient and ASC services (we can help on the analytics part)

Payer/provider collaboration for specific populations or conditions

This is a departure from 5-7 years ago, when the goal seemed to be to get to $2B of net revenue, the figure roughly associated with leveraging scale from operations and support areas.

The Steady March of AI

AI was mentioned in every single session of the Becker’s CEO conference, sometimes in passing and sometimes as a focus. One session even had a bet among panelists that they could go an hour without saying AI more than 10 times.

There are certainly hopes for AI's impact on health systems, and it is a current initiative — not a futuristic one. Applying AI in health systems applies both to clinical care (e.g. disease detection) and administrative (e.g. more intelligent scheduling).

The big question, to me, will be how AI is deployed. Will it be through hiring teams responsible for designing and implementing the application of AI? Will 3rd party vendors supply the technology and management of it? Or will we see what we did in the Automation space where the large incumbents like Epic and Cerner start to design it in to their systems?

The easy answer is “all of the above”, but whatever the case I expect AI to be a major theme in 2024.

Talent Deficit is Not Going Away

You would not have been crazy to think that, once the pandemic subsided, the battle for talent would ease up. While there are some signs of a step improvement in this area, most believe it will never get back to where it was in 2018-2019.

Talent concerns are pervasive in nearly every area. Referring to clinical functions like physicians, mid-levels, and nursing, one CEO on a panel said “We'll never be fully staffed." Others nodded in agreement.

The deficit might not be as broad-based in some of the support and administrative areas, but it still exists in pockets. I’ve been seeing a lack of strong candidates for positions like VP of Revenue Cycle.

One bright spot — for most organizations, the reliance on agency staffing (contract nurses) has eased some. The salaries being paid to travel nurses was unsustainable, so this is a welcomed development. There are still pockets however — pediatrics being one — where nursing coverage often still needs to come from the outside.

Strong Operations are Table Stakes

Strong operations - patient throughput, revenue cycle, supply chain, workforce productivity management, etc. - has moved from being a competitive advantage to being expected.

Organizations need to operate in the leanest possible way in order to free up capital for growth initiatives. What’s more, the bar is constantly being raised. What was defined as “good” in 2019 is lagging in 2023. A culture of continuous improvement is required.

We are seeing many organizations focus their energy on improvement initiatives as they move in to 2024. The top performers expect some level of improvement every single year, versus the mentality of doing a big effort on occasion and then staying status quo for years in between.

While Workforce was the key performance improvement focus in 2023, I think 2024 will be more about revenue cycle management, pharmacy improvement, and length-of-stay / discharge planning, based on the discussion I am having.

Recommended Reads / Listens

Moody’s upgraded the not-for-profit healthcare sector from negative to stable, a bit of a surprise move in many of my circles. Cited as factors were the decrease labor cost pressure, and improving cash positions. (If you want the full report directly from Moody’s, you need to register with them if you don’t already have a login.)

Julie Gurner’s interview on Ryan Hawk’s Learning Leader podcast. Dr. Gurner is one of the more insightful coaches I have come across for the senior executive level, or anyone in a high-pressure role.

Chart of the Month

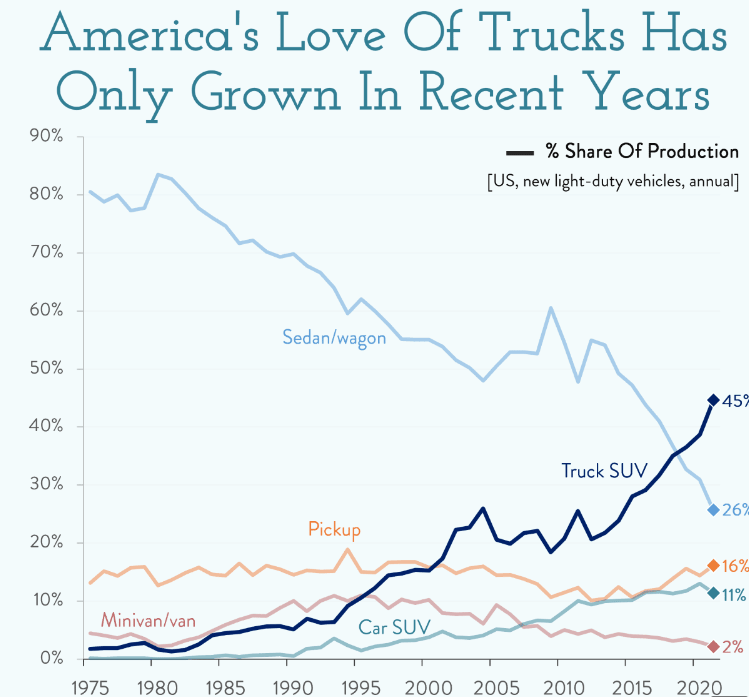

This has nothing to do with healthcare, but drives home the fact that there can be long-term secular changes in consumer preferences that businesses need to adjust to. In this case, the massive multi-decade drop in sedan and wagon market share, replaced largely by the large SUV market.